Claims of fund skimming to skipper mysterious boat

Clive Palmer’s company has been accused of dipping into a joint fund for about $4.5 million without the permission of his partnering Chinese firm Citic Pacific.

Clive Palmer’s company has been accused of dipping into a joint fund for about $4.5 million without the permission of his partnering Chinese firm Citic Pacific.

Reports in News Corp publications claim Mr Palmer’s firm Mineralogy has further aggravated its overseas backers, with revelations coming to light in an ongoing Federal Court dispute between the two.

But Mineralogy says it was owed the money, claiming Citic Pacific had failed to put in $13.4 million to the administrative fund. The mining company says Citic’s Australian division should be shut and liquidated in return.

The industrial-scale mud-flinging match is being played out before the Federal Court this week. The two firms are clashing over a dispute relating to royalty payments on the Sino Iron project in the Pilbara.

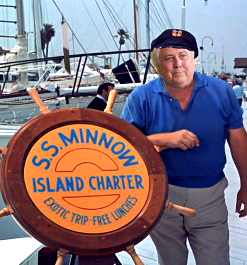

Citic’s legal counsel Andrew Bell told the court that the Chinese-owned firm believed Mineralogy had taken $2.5 million from the administrative fund to spend on a vessel that he never actually bought.

“Our understanding is that such a vessel was never acquired,” their accusation reads.

The company also alleges Palmer took another $2 million for ‘port security’, but was not actually engaged in such a role.

The Citic representative even accused Mineralogy of abusing the court process by trying to use it to close down Citic's Australian operations.

For Mineralogy’s role as Citic's landlord at the multi-billion-dollar Sino Iron project Mr Palmer says he is owed the $13.4 million, and so his company has issued a wind-up notice. Citic says the call is invalid, as it is still backed by its $5 billion Hong Kong-listed parent.

The dispute continues.

Print

Print