Terms up for big transport deal

Progress has been made on a deal for FedEx to buy-out TNT Express.

Progress has been made on a deal for FedEx to buy-out TNT Express.

The companies have reached a conditional agreement on a recommended all-cash public offer of €8.00 (AUD 11.40) per TNT Express share.

The offer is about 33 per cent higher than TNT’s recent closing prices, and about 42 per cent over the average volume weighted price per TNT Express share in the last three calendar months.

The proposal represents an implied value for TNT Express of AUD $6.28 billion. By comparison, Japan Post’s takeover offer for Toll placed Toll Holdings at a value of just over AUD $8 billion.

The deal has the support of the TNT Express Executive Board and Supervisory Board.

Major shareholder PostNL N.V. has lent its support for the offer too, offering up its 14.7 per cent TNT Express shareholding.

“The combination will transform FedEx’s European capabilities and accelerate global growth,” the board said.

“Customers will enjoy access to an enhanced, integrated global network, combining TNT Express strong European capabilities and FedEx’s strength in other regions globally, including North America and Asia.

“FedEx and TNT Express employees share a commitment to serving customers and delivering value for shareholders and supporting the communities they live and work in.”

The parties have agreed to a number of non-financial covenants, such as:

- Maintaining existing employment terms of TNT Express.

- A regional headquarters for the combined companies to be in Amsterdam/Hoofddorp.

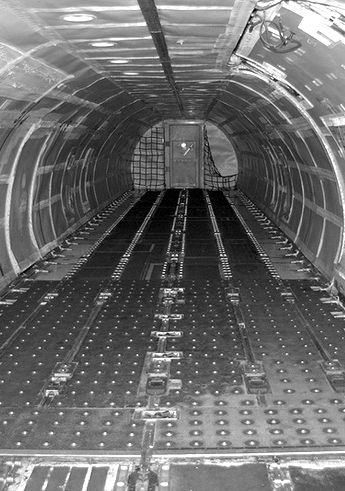

- TNT Express’ airline operations will be divested, in compliance with applicable airline ownership regulations.

FedEx and TNT Express say that the deal could be done by the first half of calendar year 2016, pending the resolution of anti-trust concerns.

Print

Print